Until something changes, platinum in particular has often popped at the end of a rally in gold and silver.

Along with platinum, gold and silver are up big today. Gold is back above resistance.

It bounced off that support several times today:

On to mining shares. These are all stocks on my extremely long list of mining stocks. These are not curated, though quite a few are “major” stocks with in the area of juniors.

Canada was on vacation yesterday, so some of this is catch-up moves.

Subscribers: if you want details on any of these stocks, ask in comments or chat.

First, a larger stock and a producer:

Hedgeless Horseman put out an article on the next stock yesterday. Perhaps that’s the driver. These are illiquid stocks. A High-Grade, Low Capex Gold Project in Quebec Looking to Push Towards Production My hot take having looked at it before: oversold, but nothing moving the needle. A common theme for these stocks in terms of analysis: given where prices are now and their advancement of the project, a rerate higher is justified.

A runner if silver takes off

Another potential runner

And another

Explorer in Afrida

Big move today on modest volume. No news. Potentially big project in Ecuador and trying to get something going in Britanny, France. Was a spec favorite due to their claim of finding the lost city of gold in 2022: Aurania and Metron Find Lost City of Gold in Ecuador

This stock has performed very well considering many juniors are nearer to 52-week lows than 52-week highs. One of the quietly good juniors advancing a relatively small project towards a mine.

One near the 52-week lows:

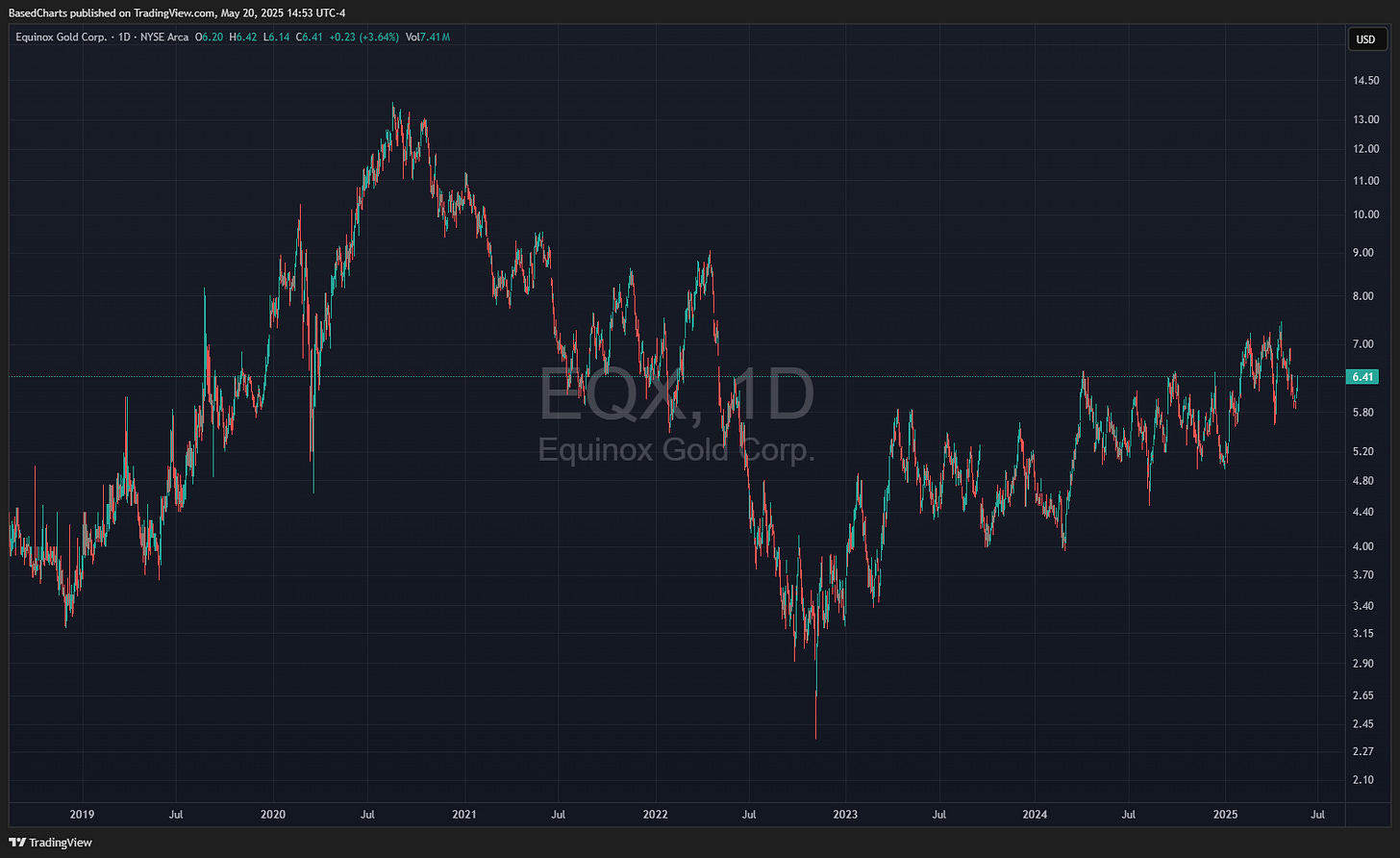

A larger producer trying to break out of a base:

I own this through a position in Commander, which is merging with them. No news. Volume is up big, but like other stocks on here, no gangbusters. Normally trades something like US$3,000 in a day. Today is closer to $20k.

STLRR was a stock with a good story, but the cost of advancing the mine caused investors to run. It’s often hit or miss in this part of the market.