Oops They Did It Again: Fed Repeats 1999

Five Rabbits and a Singularity

The 12-year cycle of animals is the most popular aspect of the Chinese zodiac. This year 2023 is one, and prior ones were in 2011, 1999, 1987 and 1975. All of these years have some relevance to this year. A lesser bear market cycle ended in 1974 (it was the nominal low, but not the inflation-adjusted low). In 1975, stocks rallied hard. They recovered almost all their losses by early 1976. The bear was caused by shockingly high inflation, similar to what was experienced last year.

The year 1987 was in the middle of a bull market, but interest rate hikes helped turn a big rally into a big crash. This seems like the least relevant of the four prior rabbits, but if the Fed started hiking again maybe not.

The year 1999 could get its own post. About 25 years ago, the Nasdaq index experienced a deep correction at the tail end of the Asian Crisis. What started with the Thai baht finished with a sovereign debt default in Russia and the implosion of Long Term Capital Management. The geniuses at LTCM were using financial models that do not accurately measure human markets. I forget the precise probabilities, but if I recall correctly, events that should happen once in multiple universes occur about once a decade.

What specifically blew up LTCM was the spread between Russian government bonds and U.S. treasuries. The spread should tighten back into a normal range, but it was blowing out. LTCM upped their bets on the spread closing. Russia went on to default. Oops.

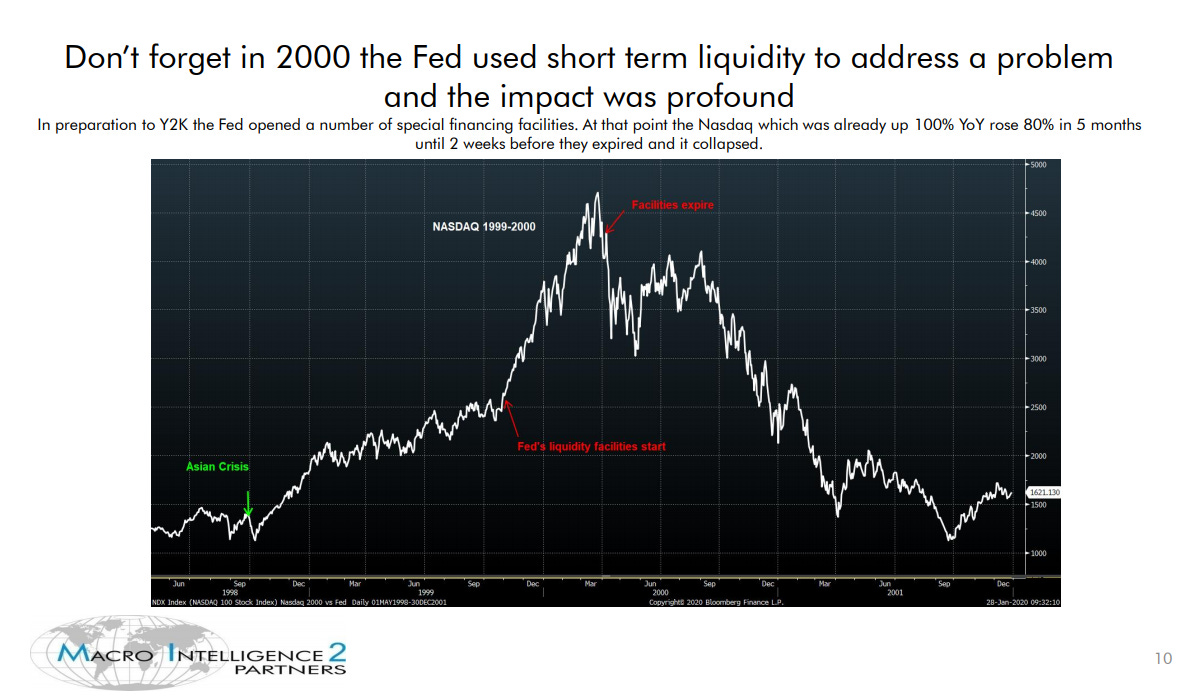

Around the same time, the tech bubble had the scare of its life. The Nasdaq corrected 30 percent. It then bottomed in October and starting drifting higher again. In 1999, there was some genuine concern about the Y2K computer bug. The Fed bought into the panic. It pumped liquidity into an already booming economy and in the midst of a tech bubble. The Nasdaq would triple off its 1998 low, gaining almost 100 percent in the final 5 months and nearly 40 percent in the final six weeks.

Bubble Time is Here Again

The theme of the late 1990s was the New Economy. Information would replace the Old Economy, manufacturing. Oops. It was true a new economy was emerging, but also that the old sectors still mattered. They’d come storming back in the ensuing decade.

The 2023 market has a story even better than the New Economy. Instead of being the new economy that displaces the old, it’s the idea of a new tech that takes over the entire economy: the singularity. It doesn’t promise high growth rates, it promises something more like infinite growth.

If an investor believes actual AI has been invented, and it can invent new products faster than humans can produce them, it will soon start directing the economy. Then the world goes weird as technological change that used to take decades starts happening in months. Extreme economic growth follows as the majority of economic activity will be AI creating an entirely new world. The logical thing to do if AI is invented and publicly ownable through shares is to sell everything you own and buy shares.

I don’t think this has been invented. I don’t think it is close to being invented. Yet I believe this story is at the heart of an “AI” bubble that will run until it runs out of money.

Boom or Bust in 2023?

It can’t be so simple as a boom, bust, boom, bust, boom pattern? If yes, then 1999 and 1975 are the relevant rabbit years. The tech angle and prior tech correction look a lot like the 1999 setup.

Let’s look at how the market behaved when the Fed stared the special financing facility for the Century Date Change (Y2K bug).

The Fed isn’t pumping now is it? There’s no special facili…

The Bank Term Funding Program (BTFP) was created to support American businesses and households by making additional funding available to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors.

March 12, 2023 press release: Federal Reserve Board announces it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors

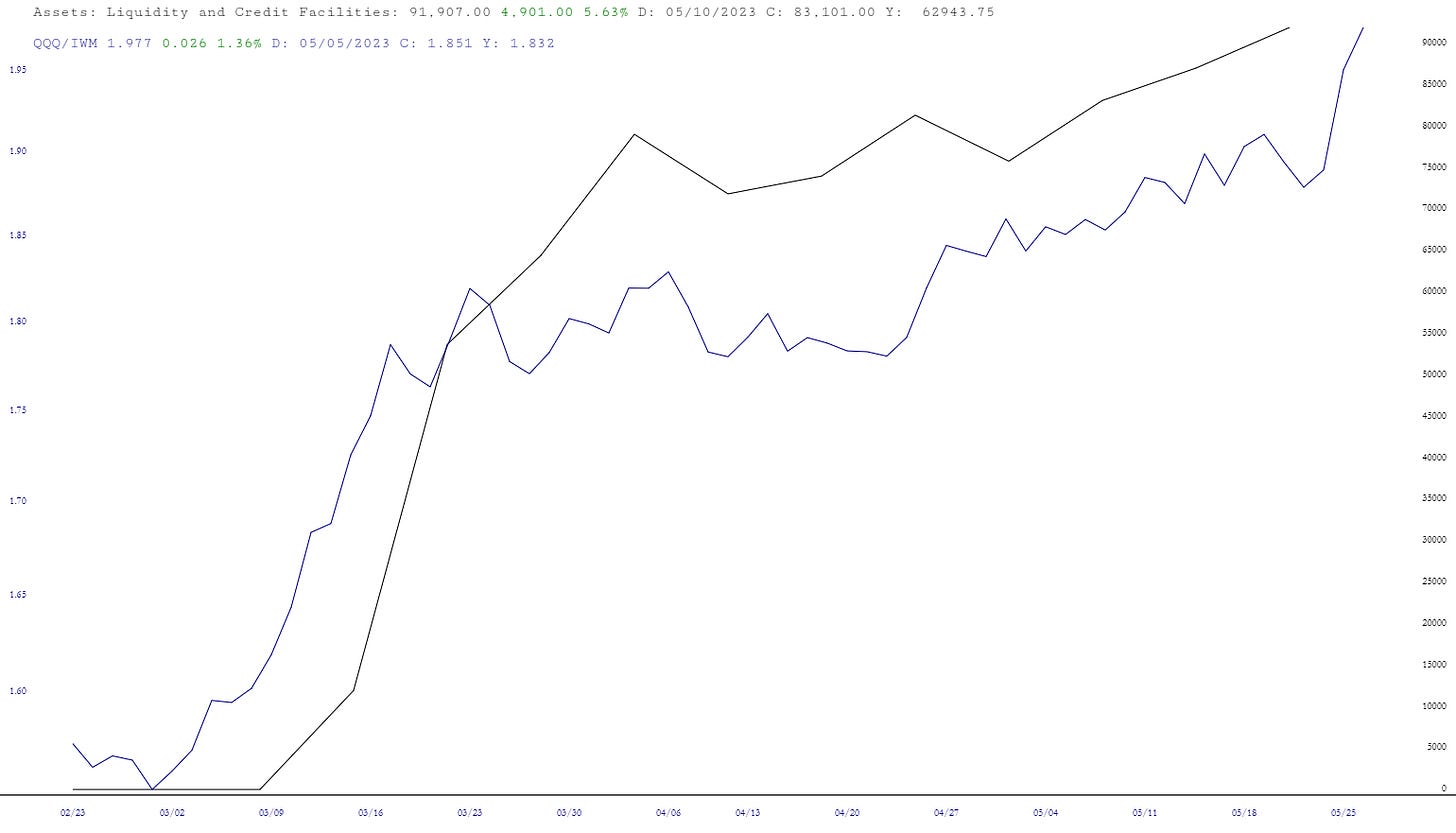

Here is the current data on special facilities, this is the BTFP started in March:

Here’s that data layered with a chart of the QQQ 0.00%↑ IWM 0.00%↑ ratio.

Zoomed in:

If enough banks go under, maybe NVDA 0.00%↑ reaches $1000 by September.