Peering Through the Fog

Yen or Euro?

Thinking through bonds and the U.S. dollar. Might the direction of RY reveal the near future?

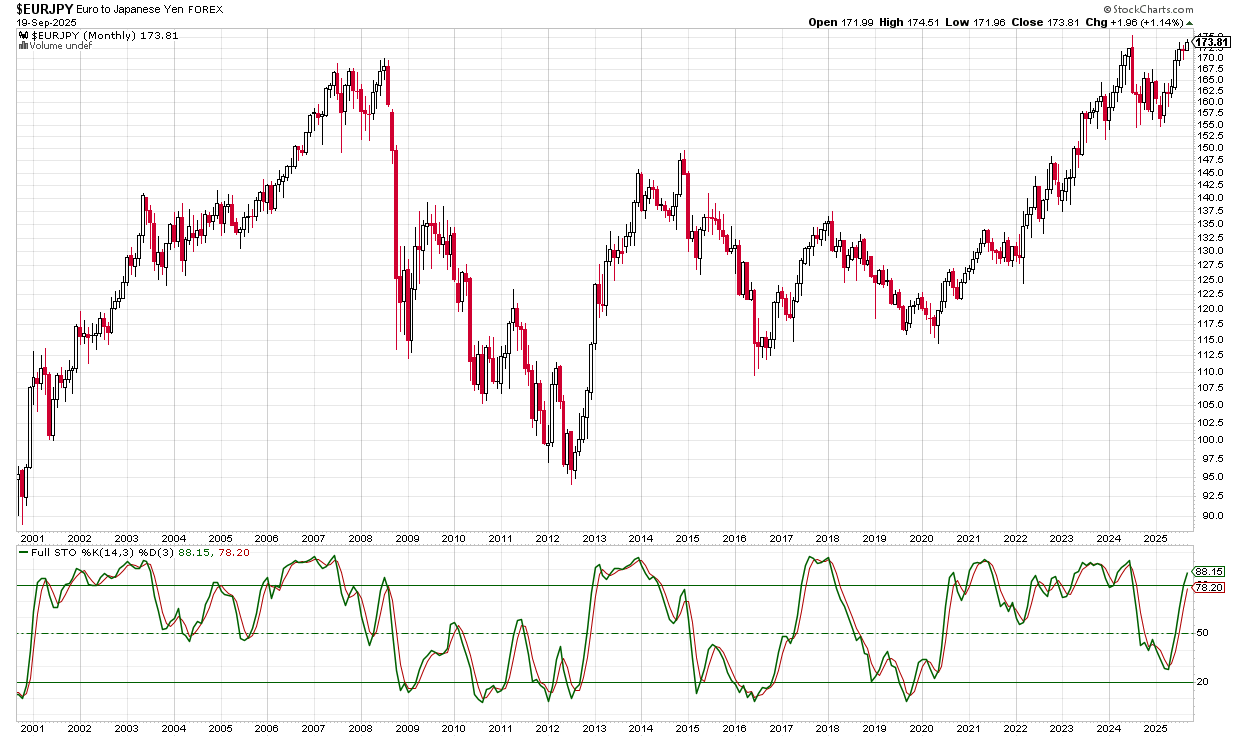

Helpfully, the EURJPY spread is at a key level.

The spread between Japanese and U.S. 10-year bonds, along with the 2s10s spread (inverted from normal).

The U.S. can afford higher rates in a way that Europe and Japan cannot. U.S. dollar down via U.S. rates catching down to Europe is significantly different from rates up in Europe because of a budget crisis.

If the U.S. makes a peace of sorts with Russia and China, with Japan and Europe feel relieved about the reduced risk of Sino-Russo-American war? Or will they feel nervous about a smaller security umbrella?

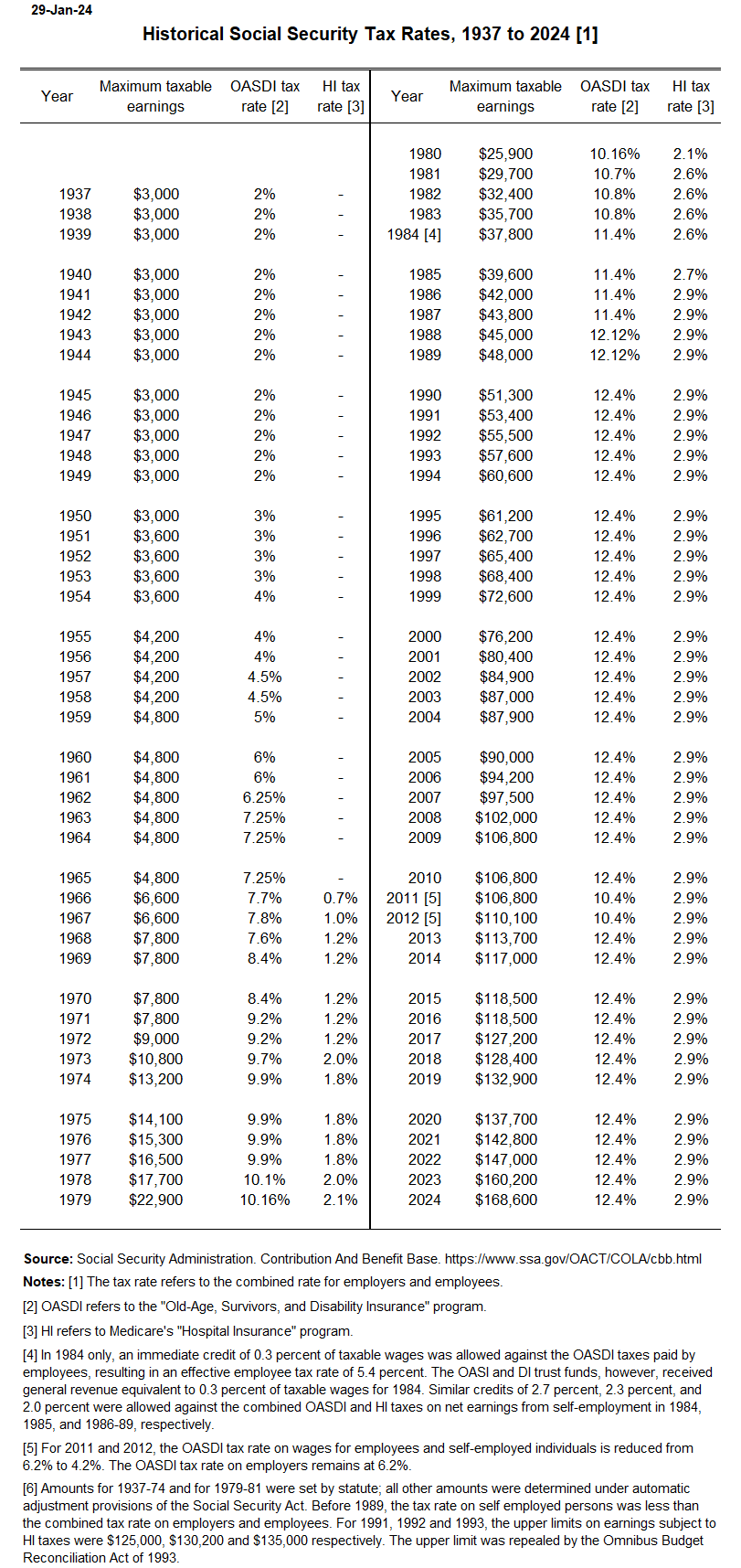

As for entitlements, most of GenX and below believe they won’t see any or will see severely reduced Social Security. They’ve already mentally accepted the inevitable cuts. Why should we expect this to end any differently than past episodes? The U.S. hiked Social Security taxes to restore solvency before.

Which countries are most likely to make pragmatic, unpopular decisions? I’ll throw in China here as well because while Xi is clearly willing to bite bullets for the long-run, failure to address the real estate market, specifically avoiding it with actions that have triggered a justified trade-war response from the USA, could very well turn into poorly-planned can-kicking until we know the final result.

Back to the original point though, the original chart. Do you see RY breaking out here? Japan has a far worse debt situation, but also a far more homogenous population. It isn’t stirring up major geopolitical trouble at the moment. The July 2024 episode shows JPY can ramp on global risk-off. Then again, they have so much debt. If this is a global debt reset unfolding, then Japan and the yen are a front-runner for first major domino.

And then there’s 2008:

Technical Points

JPY is about 25 percent of the EUR weight in DXY. USD can rally versus EUR even if it tanks versus JPY.

DXY doesn’t include China’s yuan and emerging markets, not even Mexico’s peso. It’s possible for the dollar to decline, and yet one or more major USD indexes blow-out to new highs.

Final two points, more long-term in nature but bearing on the present problems in the relevant countries.

I’m struggling to see the “worst case” scenario for the U.S. not being worse for Europe, unless populists suddenly win power—likely because the current elites fall on their swords and make unpopular changes that save Europe. A weaker dollar accelerates onshoring and a retreat of Pax Americana. It adds a macroeconomic tailwind to MAGA and populism.

What if this has changed from a game of relative performance to a game of survival?

One More Chart

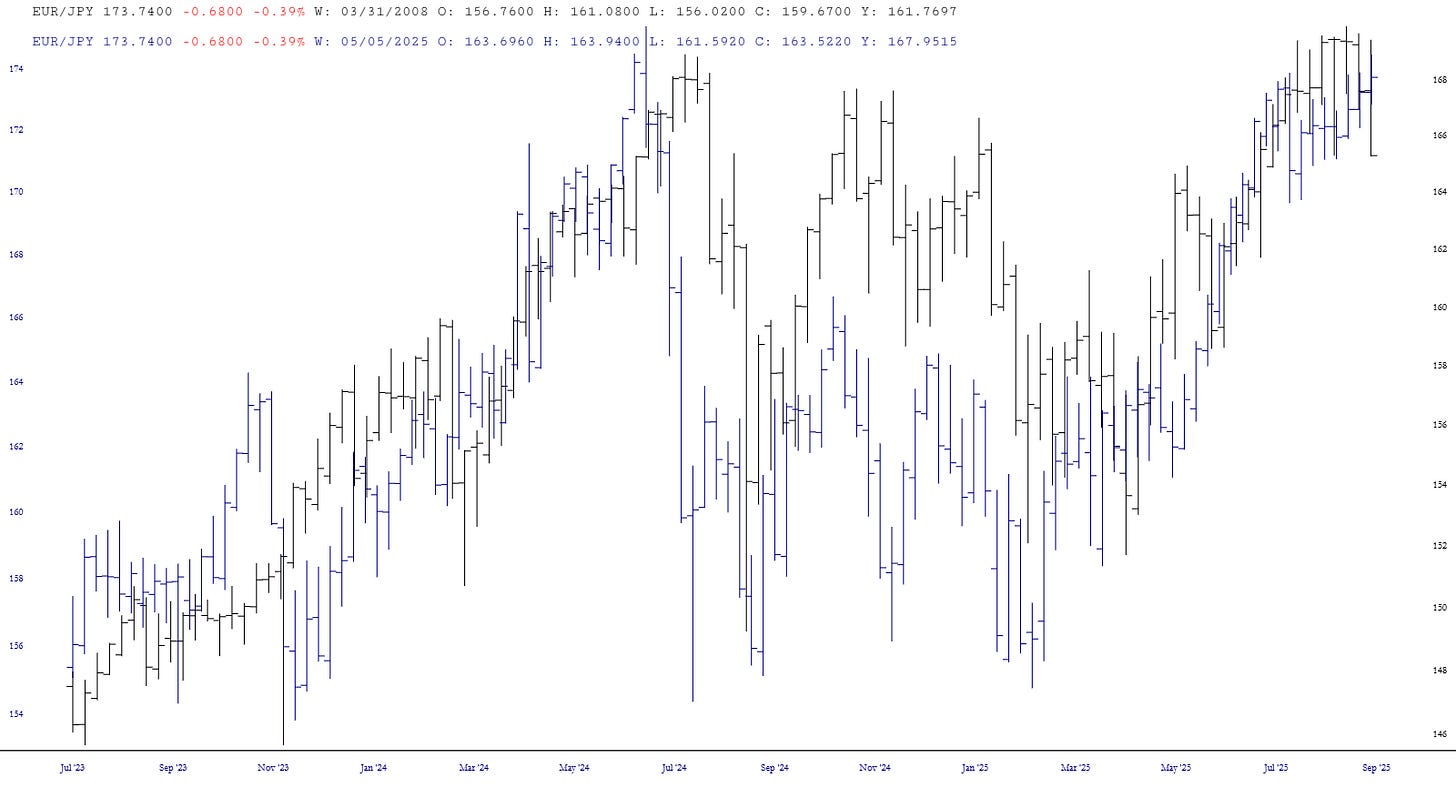

Does the 2006-2008 U-shaped top in EURJPY look like the current pattern? I layered the August 2006-August 2008 pattern with the Sept 2023 to Sept 2025 pattern.