Major ports are shuttered in the USA after longshoremen went on strike. With a close presidential election underway, the White House will not intervene lest it lose any more critical union votes. These strikes are always overhyped. It’s a big deal if it drags on, and it’s more like a nothingburger in the grand scheme of things.

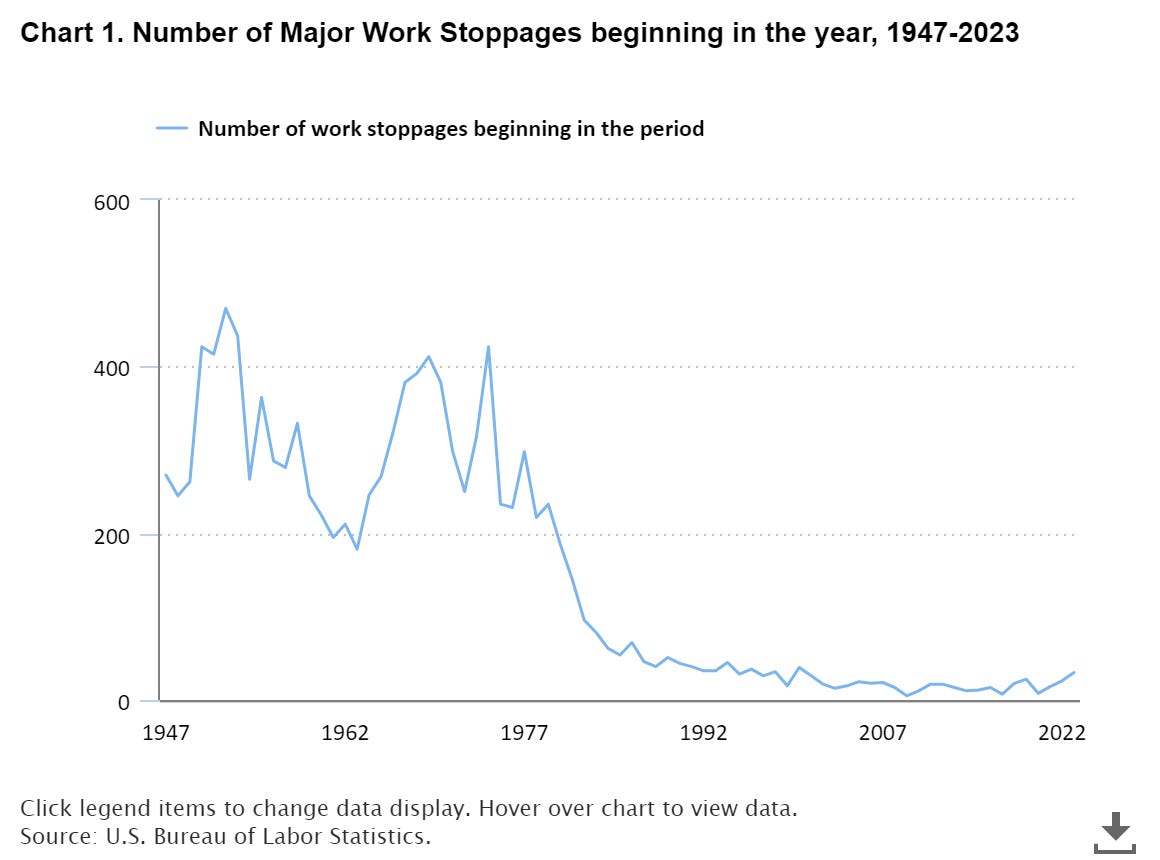

Unless this strike is a sign of the times. The median household income has gone nowhere since 2019. Public sentiment has turned against corporations. With the GOP becoming more pro-labor under Trump, there is a societal shift towards workers at the moment. The number of strikes is down, but the number of unionized workers is also down, yet the number of strikes has started turning up out of a 30-year basing pattern.

This is how ports are run in China by the way. The Chinese government has a goal of raising wages. It’s the opposite of USG’s goal of importing as much Third World poverty as possible to drive up deficits and welfare use, while driving down wages.

These are intentional decisions by two very different ruling classes. The U.S. government broke the social contract because the ruling class believes (and seemingly is correct based on events) democracy makes it immune to punishment. Whereas the Chinese government is not popularly elected and is very concerned about its legitimacy, and therefore has improving public welfare as a goal. The U.S. is entering a dangerous period where labor doesn’t trust capital to make automation work for the greater good. The union is both correct to strike in one sense and totally wrong with their stance on automation.

In the broader economy, the housing market remains a question mark for growth.

Mish Shedlock: Housing Starts Are Tumbling as Completions Soar, It’s Very Recessionary

The discrepancy between housing starts and completions is the largest since 1980.

Pay attention whenever seeing “since” and the year is 1973-1982 or the 1930s.

To the Charts

Boeing is at lifetime support. It’s about 25 percent down to the 2022 low and 40 percent down to the 2020 low if selling picks up. More than an individual trade, it’s yet another now-former Blue Chip stock that has broken an uptrend stretching back 30 or 40 years…correlating with the end of a 40-year bull market in bonds. NKE and PFE are still well below their long-term uptrends, MMM rebounded, CLX rebounded but still hasn’t recovered that trendline.

COST lost resistance. The monthly topping signal flickered off at the day’s low.

SMCI split 10 for 1, thus the target moves from $200 to $20.

LLY is holding up the healthcare sector with a rebound today. XLV bounced near its 50-day moving average. A break of horizontal support will open a move back to $148 area.

KRE major support at $52.80. Monthly stochastics is in the overbought zone, but rolling over. Both XLF and ITB are struggling at resistance.

Implied correlation popped today. This provides good clarity for people struggling with the desire to pick pennies up in front of a steamroller. When the market rallies, implied correlation drops. Implied correlation in the area of 10 or below is a level associated with market tops. Normalizing these readings requires lower prices unless some kind of positive Black Swan appears and makes equity valuations cheap again. The market didn’t normalize after the July plunge, it merely chased the same trades that created the July plunge in the first place.

It’s a shooting gallery out there.

Charts such as Blackrock are at a crossroads as well. There’s a large base, it’s at all-time highs, it’s overbought on the monthly stochastics. Everything that says melt-up or big monster rally can unfold. Which is it? A huge move higher from already elevated levels in the market, maybe because Trump wins and everyone expects huge tax cuts? or does the reversal from a peak being no matter what?

Weakening charts: CMG, EXAS, EPAM, ENPH, FCX, FIVN, AMZN, ILMN, ANET, INTU, NOW.

Reversal candidates: NFLX, META, MCD, VST, XLU

A simple index I made of pools, snowmobiles, boats and RV stocks:

Similar deal with this Canadian bank index: